February 4, 2011

How BP Can Clear its Name: Invest 30% in Clean Energy

Jackie Savitz is Oceana’s Senior Campaign Director for Pollution Programs. This post originally appeared at the Huffington Post.

In the 7,000-word State of the Union, President Obama seemed to leave out two letters that loomed large in 2010. “B” and “P” — the initials of the company that destroyed the lives and livelihoods of Gulf of Mexico residents and did immeasurable destruction to Gulf ecosystems.

But BP was there in spirit. Its campaign contributions helped get many members of Congress and Senators elected, it was implicated in the oil industry effort to paper Washington, D.C. metro stations with ads, and just the day before, the halls of Congress were filled with lobbyists and others clamoring for seats at the Oil Spill Commission hearings.

And while the President didn’t say those two letters, BP was implicated in his statement that we need to get 80% of our energy from clean sources by 2035. Because who would be better than BP, a company tarred and feathered and now in need of a clean break, to help us build our clean energy portfolio so it can provide 80% of our electricity by 2035?

Let’s face it, BP owes the American people a lot more than just those damages checks. The spill took an immeasurable toll on our fisheries and on the marine ecosystem. The marine life in the Gulf will never really be “made whole” no matter how big the fines are. What can BP do to make it up to us? The answer goes back again to those same two letters: B-P. The company should now, really and truly get “Beyond Petroleum.”

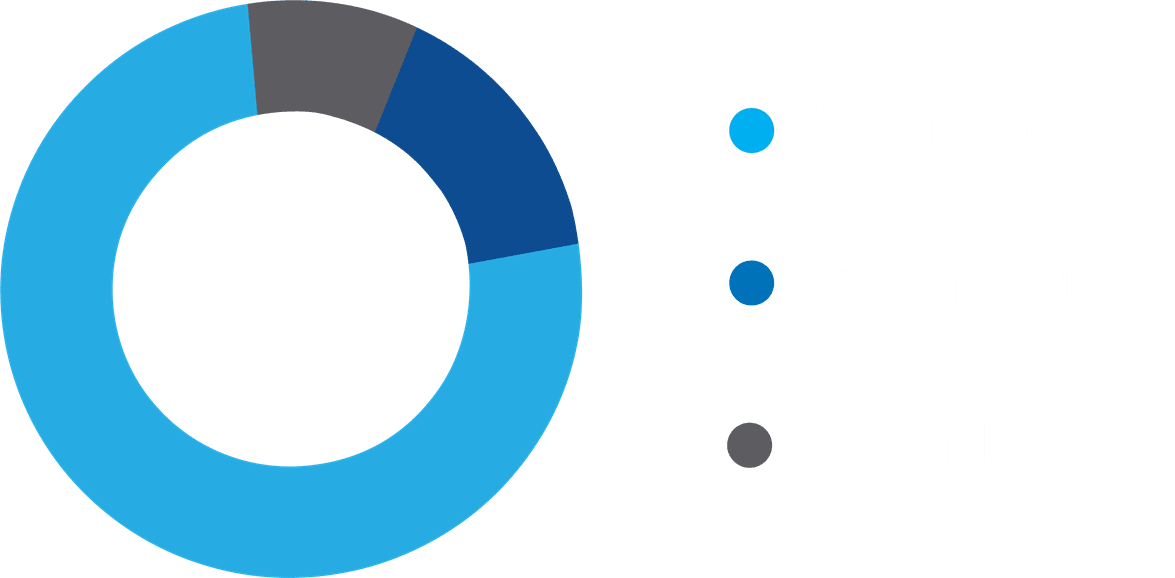

“Old-style energy” needs to give way to “new energy” and companies that help to shepherd that will have a role to play in the energy future. So far, BP has made paltry investments in clean energy, much less than you’d think after seeing its green-washed advertising campaign, or considering its shear wealth and tremendous profits. After all that, the company has committed to put only about 6% of its total investments into clean energy. Why not 30%?

For comparison, look at another company, like General Electric. GE certainly has skeletons in its closet, but the company plans to have 30% of its investment portfolio in clean energy by 2015. Why can’t BP do the same?

By the way, most of BP’s 6% shouldn’t even qualify as clean. More than a third of it is slated to go into biofuels that don’t necessarily get us a net reduction in carbon dioxide, and so-called carbon capture and storage. Even worse, in 2009, BP planned to put another $12 billion into tar sands. That, in itself, is three times more money than it was planning to invest in clean energy.

BP has a long way to go to get to 30% but the company can learn a lot from GE, whose “Ecomagination” projects include development of offshore wind, solar installations and smart grid technologies. BP could learn from GE that investment in alternative energy pays. GE has made $70 billion in revenue in five years on its Ecomagination projects and the profits are still growing. GE has already taken $6 billion in revenue from its $1.5 billion investment in wind farms.

Who cares whether they do it for the money or just to clear their name. But if BP ever wants consumers to think of it as something other than that oil company that put profits before safety and trashed the Gulf of Mexico, the company is going to have get in the clean energy driver’s seat. Investing 30% of total spending — the same percentage as GE — on clean alternative energy would be a good start.

MOST RECENT

September 3, 2025

Air Raid Panic to Informed Skies and Seas: The National Weather Service in a Nutshell

August 29, 2025

August 22, 2025

Corals, Community, and Celebration: Oceana Goes to Salmonfest!