Report | February, 2014

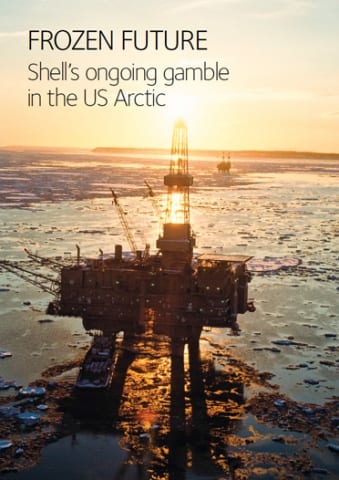

Frozen Future: Shell’s ongoing gamble in the U.S. Arctic

Royal Dutch Shell stands at a strategic crossroads. Its response to the reserves scandal in 2004 has been a global reserves replacement hunt through a programme of relentless capital expenditure. This search included an investment in US Arctic Ocean leases in the mid-2000s that dwarfed other companies’ spending. Shell’s US offshore Arctic plans have been a failure despite capital expenditure, to date, in excess of $5bn.

Investors in IOCs are increasingly questioning allocation of shareholder capital to high cost, high risk projects such as offshore Arctic drilling against an industry backdrop of flat share prices and declining returns on equity even through a period of sustained $100/barrel oil prices. The US Arctic Ocean presents almost a perfect storm of risks – a requirement for a long-term capital-intensive investment for uncertain return, a remote and uniquely challenging operating environment, ongoing court challenges, a lack of extraction and spill response infrastructure, and the spotlight of the world’s environmental organisations, the US political community and international media. In this context, investors must scrutinise Shell’s assessment of such risks and the company’s ability to mitigate and manage them in order to determine whether the potential return provides sufficient justification to continue.